Patronage

When you’re a member of the Co-op, you’re also an owner. That means you share in the profits.

The patronage system allows us to share and reinvest those profits and keep the dollars in our local communities.

Co-ops are just built differently.

A cooperative is a business built to work for its members, not just for maximum profit for a few people.

Here’s how you can join us.

Step One:

Become a member.

Join over 14,000 other folks in Central Montana to become an owner / member.

Step Two:

Do business with the Co-op.

The more business you do with the co-op, the more of the profits you’re eligible for.

Step Three:

Reap the rewards.

Cash patronage and allocated equity are distributed each December.

We’ve paid back 27 million dollars

over the last five years.

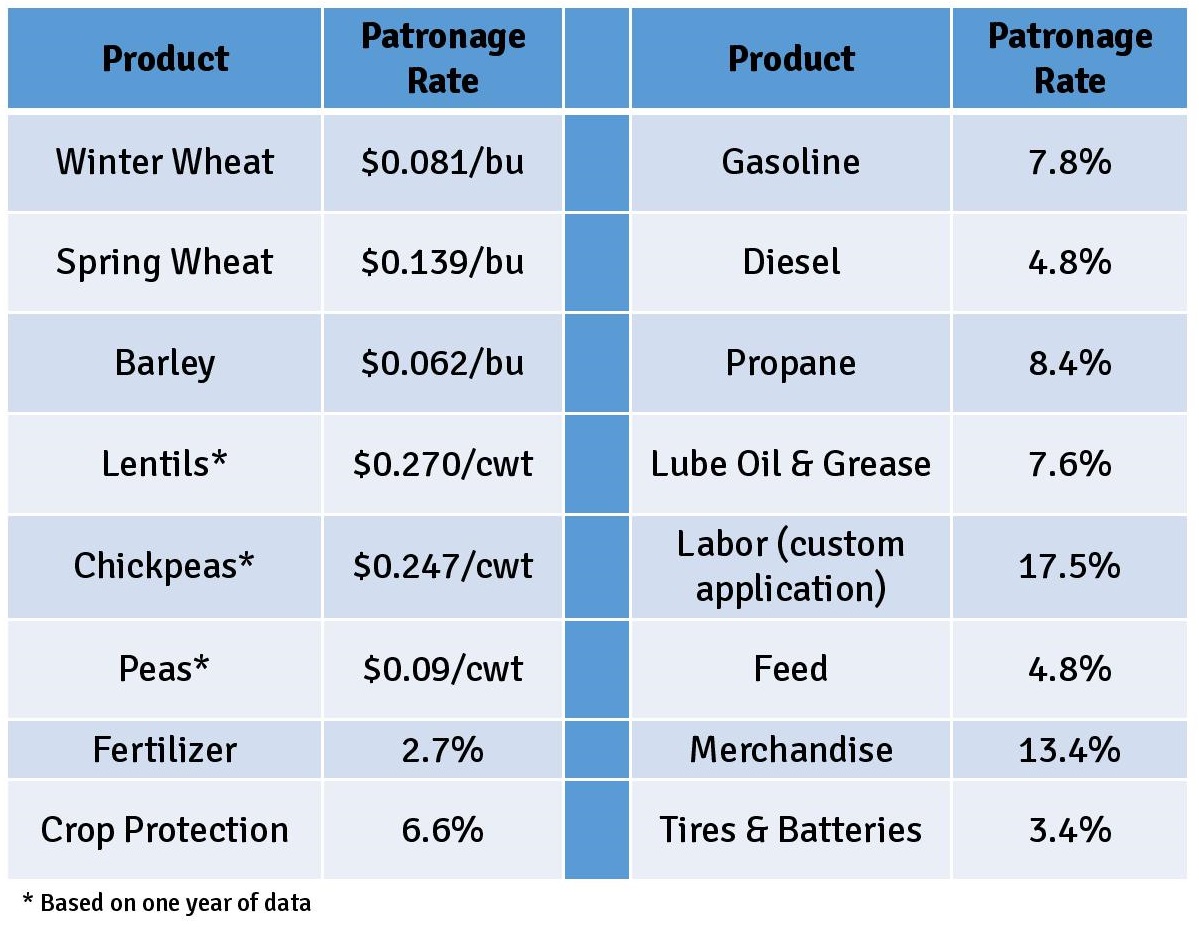

The chart below shows our average patronage rates for 2014-2018.

Money back on Fuels

More money for crops

Money back on chemicals

Money back on retail

Frequently asked questions

A co-op is a member-owned and member-controlled business that operates for the benefit of its members.

Patronage is the distribution of a co-op’s profits back to its members. The amount each member receives is generally based on the amount of business they do with the co-op in a fiscal year.

There are two components of patronage, cash and equity. Co-ops are required to pay back at least 20% of the profits back to members in cash; typically Mountain View Co-op pays 40% in cash. The balance is distributed as “Allocated

Equity”. See below for more on that.

The rates are determined bases on sales and profitability for each respective commodity.

Any member who earns at least $50 in total patronage, maintains an account in good credit standing, and has signed the proper patronage forms will receive patronage.

Yes. A 1099 Patronage IRS form will be mailed to you each January.

Equity is the portion of patronage that is retained and used for operating the co-op.

Individuals are eligible to have their equity “retired” when they reach the age of 70. MVC pays out equities of of estates as requested.

Since you paid the taxes on the patronage the year it was allocated, equity redemptions are not considered taxable income.

Still have questions?

We’re always happy to help.

Phone

(406) 453-5900

Address

1030 Montana Ave NE, Black Eagle, MT 59414